For many Singaporeans, the concept of a credit score may seem abstract until the day it becomes an obstacle. You might discover your score is lower than expected when you try to secure financing whether for emergency medical expenses, business needs, or to consolidate debt. While banks in Singapore tend to prioritise applicants with excellent credit histories, having a bad credit score does not mean you are out of options. Licensed money lenders in Singapore provide a regulated and legal alternative for those facing financial difficulties.

This article explores how Singapore’s credit system works, why some borrowers struggle with bank approvals, and how you can still qualify for a personal loan Singapore even with less-than-perfect credit.

Understanding What a Bad Credit Score Means in Singapore

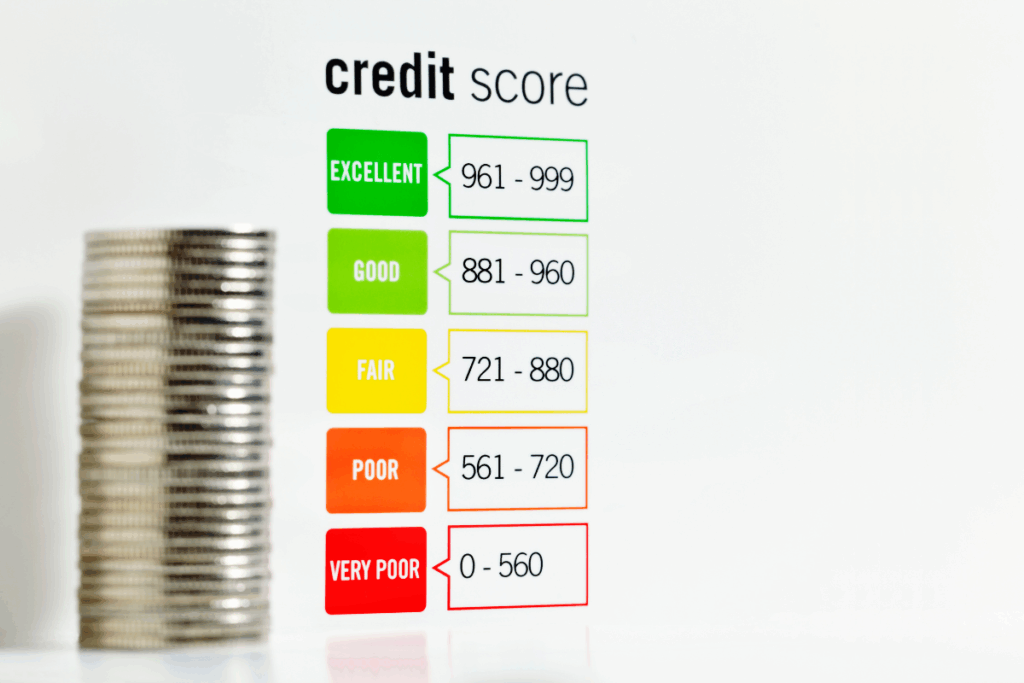

In Singapore, your credit score is essentially your financial reputation a number that represents how likely you are to repay borrowed money on time. The Credit Bureau Singapore (CBS) is the primary agency that tracks this data. They assign a score ranging from 1,000 to 2,000, with 2,000 being the most creditworthy.

A bad credit score typically falls below 1,800, signalling higher risk to lenders. This can result from missed payments, maxed-out credit cards, loan defaults, or frequent applications for new credit lines. Banks and financial institutions use this score to evaluate your reliability. The lower your score, the less likely you are to qualify for traditional loans.

However, it is important to understand that a bad credit score does not define your entire financial worth. It simply reflects your past behaviour with credit and crucially, it can be improved over time.

Why Banks May Reject Your Application

Banks in Singapore are known for their rigorous screening processes. They rely heavily on credit reports and financial ratios to decide whether to approve a loan. When your credit score is low, they often interpret it as a sign of risk, leading to rejection even if your income has improved or your financial circumstances have changed.

Common reasons banks may decline your application include:

- High Debt-to-Income Ratio

If a large portion of your income already goes towards paying existing loans or credit cards, banks will consider you a risky borrower. - Irregular Income Sources

Freelancers, self-employed individuals, and gig workers sometimes face rejection simply because their income is unpredictable. - Negative Credit History

Late payments or defaults from years ago can continue to affect your credibility. - No Credit History at All

Ironically, having no borrowing record can also hurt your chances, as banks have no data to assess your repayment habits.

When faced with such situations, many Singaporeans turn to a money lender Singapore for alternative solutions.

The Role of Licensed Money Lenders in Singapore

Licensed money lenders play a vital role in Singapore’s financial landscape. They are regulated by the Ministry of Law (MinLaw) under the Moneylenders Act and the Moneylenders Rules. This legal framework ensures that borrowers are protected from unfair practices while giving individuals with poor credit access to much-needed funds.

Unlike illegal loan sharks, licensed money lenders must comply with strict regulations, including:

- Transparent disclosure of interest rates and fees

- Caps on maximum interest rates (currently up to 4% per month)

- Limits on late payment fees

- Prohibition against harassment or abusive collection tactics

Before engaging any lender, you should always verify their legitimacy by checking the official list of licensed money lenders on the Ministry of Law website. This step ensures you are dealing with an authorised provider and not a scammer.

Licensed money lenders evaluate your application more holistically than banks. While your credit score remains a consideration, they also take into account your income stability, employment status, and repayment ability. This makes them a practical option for people with lower credit ratings who still need financing.

How to Qualify for a Loan with a Bad Credit Score

Securing a personal loan Singapore from a licensed money lender with a bad credit score is entirely possible if you prepare strategically. The key is to present yourself as a responsible and capable borrower. Here are practical steps to improve your approval chances:

- Gather All Required Documents

Money lenders typically request proof of income, NRIC, CPF contribution history, and recent payslips. Having these ready demonstrates transparency and readiness. - Show Consistent Employment

A stable job or steady freelance income reassures lenders that you have the means to repay the loan. - Borrow Within Your Means

Licensed money lenders will assess your affordability before granting the loan. Borrow only what you truly need not the maximum amount available. - Clear Outstanding Debts

Paying off small existing debts before applying can significantly improve your perceived reliability. - Be Honest About Your Situation

Trying to hide bad credit or false information can harm your chances. Licensed lenders appreciate honesty and often work out repayment plans suited to your situation.

By following these steps, borrowers with weaker credit histories can still obtain loans safely and responsibly.

Comparing Bank Loans and Licensed Money Lenders

It is essential to understand how banks and licensed money lenders differ so that you can make informed decisions.

| Criteria | Banks | Licensed Money Lenders |

| Credit Requirement | High | Flexible |

| Approval Time | 3–7 days or longer | Often within 24 hours |

| Interest Rate | Usually 3–8% per annum | Up to 4% per month |

| Loan Amount | Larger | Based on income limits |

| Eligibility | Strict, credit score-based | Broader assessment including income stability |

| Regulation | Monetary Authority of Singapore (MAS) | Ministry of Law (MinLaw) |

While banks offer lower interest rates, their requirements are often too strict for those with poor credit. On the other hand, a money lender Singapore provides accessibility, speed, and flexibility though at higher costs. Borrowers must weigh convenience against affordability.

Tips to Improve Your Chances of Approval

Even if you have a poor credit score, taking certain proactive steps can improve your eligibility.

- Check Your Credit Report

Obtain a copy from Credit Bureau Singapore to understand where you stand. This will also allow you to identify and correct any errors that might be affecting your score. - Demonstrate Financial Responsibility

Pay bills on time, reduce credit card balances, and avoid applying for multiple loans at once. These behaviours show lenders that you are committed to improvement. - Build a Positive Relationship with a Money Lender

If you have successfully repaid small loans in the past, this can build trust. Responsible borrowing today can lead to better terms in the future. - Seek Financial Counselling if Needed

Non-profit organisations like Credit Counselling Singapore (CCS) provide professional advice to help manage debt more effectively.

These actions not only increase your chances of loan approval but also help you rebuild your creditworthiness in the long run.

Responsible Borrowing: What to Know Before You Sign

Before taking a personal loan Singapore, it is crucial to read and understand all terms and conditions. Licensed money lenders are required to explain the repayment schedule, interest rates, and penalties in clear language. Do not rush through the process take time to evaluate your ability to meet repayments.

Here are several reminders for responsible borrowing:

- Understand the Interest Rate Structure: Interest rates for licensed money lenders are regulated but can still add up if repayments are delayed.

- Clarify All Fees: Confirm whether there are administrative charges, late payment fees, or early settlement costs.

- Never Borrow More Than Necessary: Taking a loan larger than what you can afford could lead to further financial distress.

- Keep All Receipts and Contracts: Always ensure you receive a copy of your loan agreement and payment receipts for your protection.

- Avoid Unlicensed Lenders: Loan sharks may promise easy money but often engage in harassment and illegal interest charges.

Responsible borrowing is about ensuring that your loan serves as a temporary aid rather than a permanent burden.

Improving Your Credit Score for Future Borrowing

Getting a loan from a licensed money lender Singapore can help you address urgent needs, but it should also be viewed as an opportunity to rebuild your financial record. By making timely repayments and managing your finances prudently, your credit score can gradually recover.

Here are some effective ways to improve your score:

- Pay on Time, Every Time: Consistent repayment history is the single biggest factor in boosting your score.

- Keep Credit Utilisation Low: Aim to use less than 30 per cent of your available credit limit.

- Avoid Frequent Applications: Each loan or credit application creates a hard enquiry that can temporarily lower your score.

- Monitor Your Progress: Check your credit report at least once a year to track improvements.

In the long term, these habits will help you qualify for better loan terms from both banks and licensed money lenders.

Real-Life Example: From Rejection to Approval

Consider a scenario where a Singaporean resident, Alex, faced repeated rejections from banks due to his history of missed credit card payments. After checking the Ministry of Law’s list, he applied for a personal loan Singapore through a licensed lender. The lender evaluated his steady employment record and current income instead of relying solely on his credit score.

Alex received a modest loan amount to cover urgent car repair costs. By repaying on time each month, his credit reputation gradually improved, opening doors to better financial options later on. This example demonstrates that with proper planning and discipline, borrowing from a licensed money lender can be a responsible step towards recovery.

Final Thoughts

Having a bad credit score can be discouraging, especially in a financial environment as structured as Singapore’s. However, it is not the end of your financial journey. Licensed money lenders provide a legal, transparent, and regulated means to access credit when banks turn you away.

Whether you are dealing with medical bills, home repairs, or debt consolidation, a money lender Singapore can offer flexible solutions provided you borrow responsibly and understand the terms fully.

Remember, your credit score is not permanent. With consistent repayments, careful budgeting, and financial mindfulness, you can rebuild your reputation and regain control of your financial future.If you are exploring your options for a personal loan Singapore, take time to compare lenders, verify their licences, and assess your repayment capacity. The right decision today can set the foundation for a stronger, more secure tomorrow.